There are idiosyncrasies within the NIL space that the typical fan – or reporter – might not think about regularly, if at all.

Among the top concerns for athletic departments as it pertains to their athletes that might not cross the public’s mind is Uncle Sam’s cut. Any money received from collectives, any cars or products collected in deals, endorsements, even digital acquisitions like NFTs, all NIL earnings are taxable income.

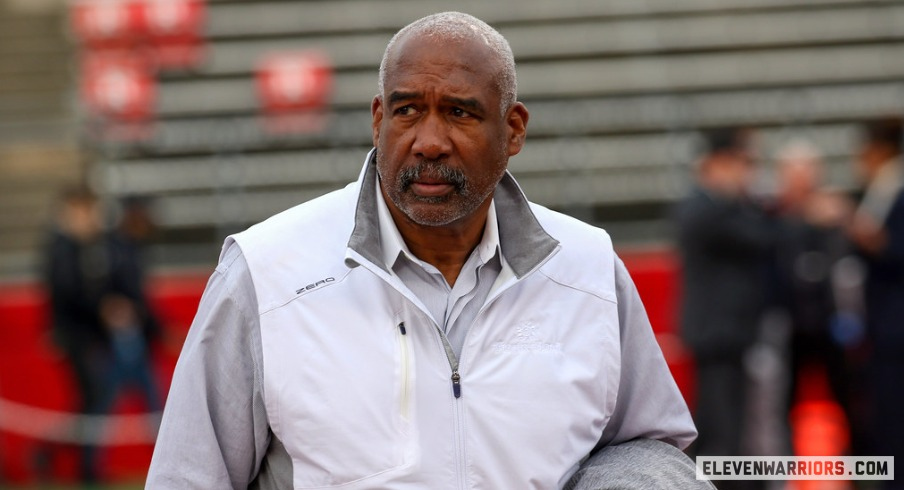

“If you do a deal and you get paid in gross, you got a whole backer percentage (you owe in taxes),” outgoing Ohio State athletic director Gene Smith told Eleven Warriors. “Otherwise, your parents are going to get called by the IRS. So don't worry about the NCAA, worry about the IRS. So we started that, to your point about being a little bit more focused on that part of financial literacy. And there's some other elements in there as well.”

Especially with revenue sharing on the horizon for next year, financial literacy is now an important skill for college athletes at top schools like Ohio State. That factoid may not make for a juicy headline, but when teenagers are coming into sums of cash they’ve never neared seeing before, money management needs to be learned alongside the ins and outs of cover three.

“The biggest thing is you’ve got to think different budgetarily,” Smith said. “You have to pay more attention to this new ecosystem and making sure that you have a stronger emphasis on financial management, teaching that with student-athletes. They're going to come into the revenue share process, they're going to come into more money. So, making sure that your financial literacy program is the best that it can possibly be.”

With financial literacy being an important skill in the working world, the Buckeyes were teaching athletes how to regulate their funds long before they were allowed to make money off of their name, image and likeness.

“It's been in place for years. It probably (started in) 2013, somewhere in there we really got deep into it and started doing a better job with it,” Smith said. “There's so many life skills that we teach. We require all of our sophomores to have résumés. Think about that. Many of our student-athletes have never worked before in their lives, and all of a sudden, they’ve got to write a résumé. They’re like, ‘Oh, I’ve got nothing to put on it.”

Still, NIL put the proverbial gas pedal to the floor of the McLaren when it came to educating players on this subject matter. Collegiate stars come from a diverse array of backgrounds, plenty of them from less-than-ideal economic circumstances.

In the past that meant some needed to know how to report Pell Grants – financial support given by the U.S. Department of Education to students from low-income households – on tax documents. Now it’s being wise with six- or seven-figures worth of earnings and a much more complex 1040 form filing process.

“We did ramp up around NIL. We ramped that up and talked more about taxes,” Smith said. “We always taught taxes, but we were more about taxes talking to Pell-eligible student-athletes around tax season, I remember having a Zoom with parents and our football team – I think it was two months before NIL was enacted – and asked all of our football players, ‘How many of you pay taxes?’ Zero.”

Revenue sharing is now all but a done deal to start in 2025 thanks to a trio of antitrust lawsuits settled by the NCAA. In those settlements, the organization agreed to permit schools to share a revenue figure of up to 22% of what the average power conference athletic department generates in a year.

Smith noted that an athletic director has to think differently with all the money that is now tied in with sports, though he does expect things to stabilize much further after the first year of revenue sharing. The Buckeyes hope to sustain all 36 of their varsity sports, so their own budgetary savvy and monetary engine will be tested.

“I think we're well-positioned. We started to reduce expenses in a lot of different areas, big time,” Smith said. “We started two years ago a revenue generation committee to, think about other things we could do to generate revenue. I mean, you guys saw it. I never thought we'd be playing golf in (Ohio) Stadium. We had 11,000 people play nine holes of golf in the stadium.”

"I never thought we'd be playing golf in (Ohio) stadium. We had 11,000 people play nine holes of golf in the stadium."– Gene Smith on generating extra revenue

Nearing retirement, Smith is confident that the Ohio State athletic department remains prepared to help players navigate the income they generate.

“Our (financial literacy program) is really good, but everything needs to be looked at,” Smith said. “So, there's just a whole lot of things with that. Just really, really more attention to some of those details. The money is going to be the money and that's reality. We're going to be told what it's going to be and then you’ve just got to embrace that change and roll with it.”

Above all else, Smith hopes the focus of athletic departments remains on setting student-athletes up for life beyond their given sport.

“We've been fortunate where our student-athletes historically have graduated in less than four years,” Smith said. “Now I'm worried about whether we can maintain that because remember, graduation is the holy grail. ... You have the Olympics and you have (athletes who go) pro. And that's only like 1%. So the rest of them got to find jobs and you need that sheepskin in order to find a job. So I think that that focus has to always continue to be part of our culture and something we tether to.”